Hello everyone,

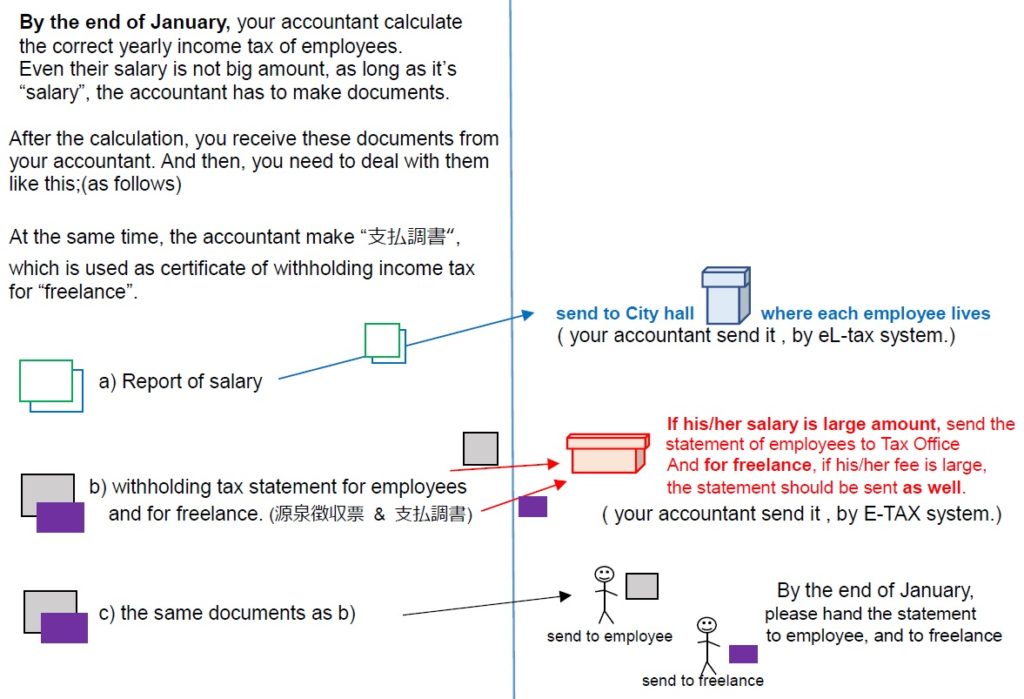

From December to January, company need to issue two kind of documents for the staff.

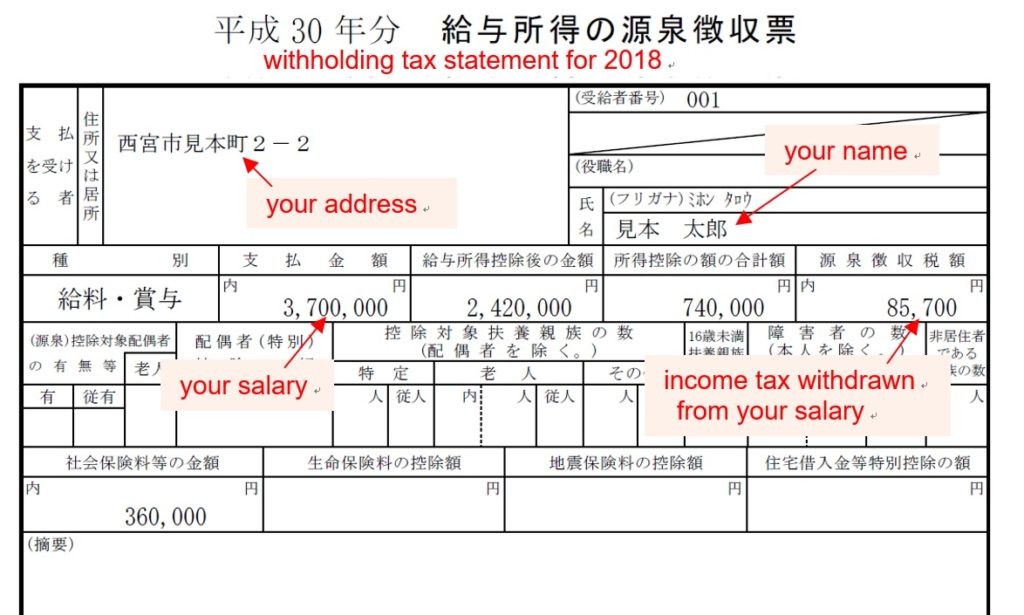

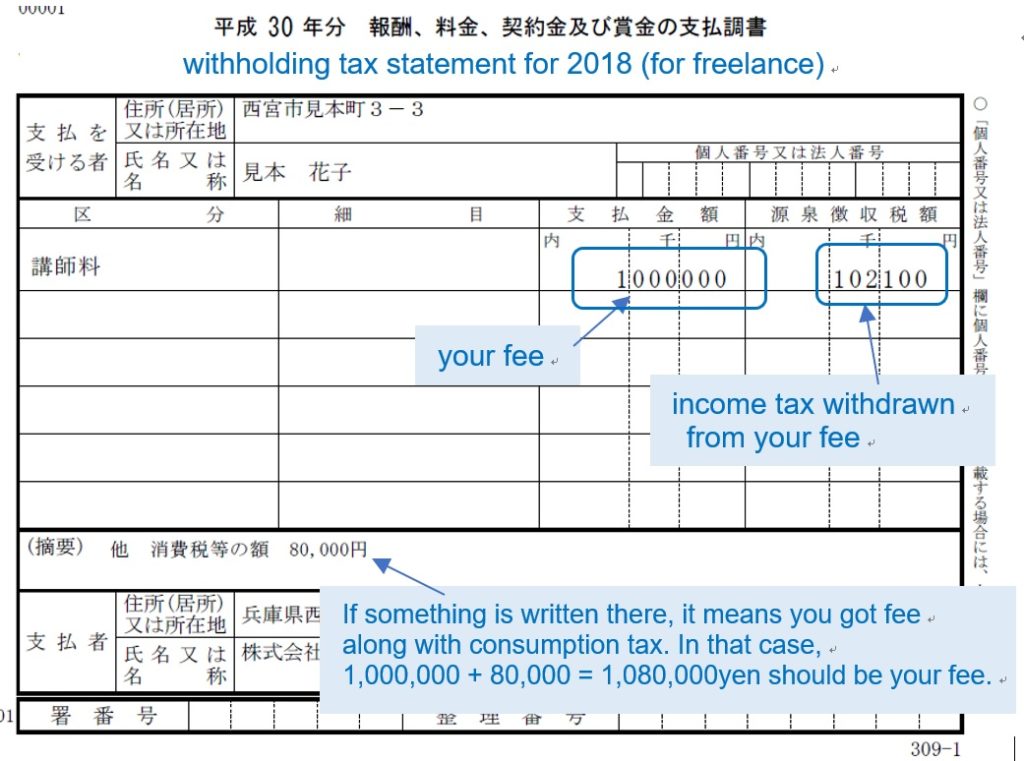

One is called “Gensenchoshu-hyo(源泉徴収票)”, another is “Shiharai-chosho(“支払調書”).

I explain about it roughly at this movie. (within 3 minutes)

In addition, I’ll show you these imformation.

If you received Gensenchoshu-hyo(源泉徴収票),please check these points.

↓ ↓ ↓

When you find you should have more deductions, you can do tax filing

after you receive the Gensenchoshu-hyo(源泉徴収票).

And, if you have 2 more jobs, you need to do tax filing !

On the other hand, if you receive “Shiharai-Chosho(支払調書)”, please check these points.

↓ ↓ ↓

If you received it, you need to do tax filing.

Because it says here your income tax was withdrawn, but Local inhabitant tax was not.

In fact, all employer need to submit the report of income tax and of local tax for their employees.

But,for freelance, the employer don’t need to submit the report of local tax.(as follows;

In Japan, tax filing season is Feb.~Mar. and the deadline is ” 15th, Mar.”

Meeting deadline is very important thing !

If you have any question, please e-mail me and make an appointment.

My clients can see the “Clients Only” page on my website, I recommend check it (https://cieltax.jp/login.php )

Have a nice weekend !

🙂