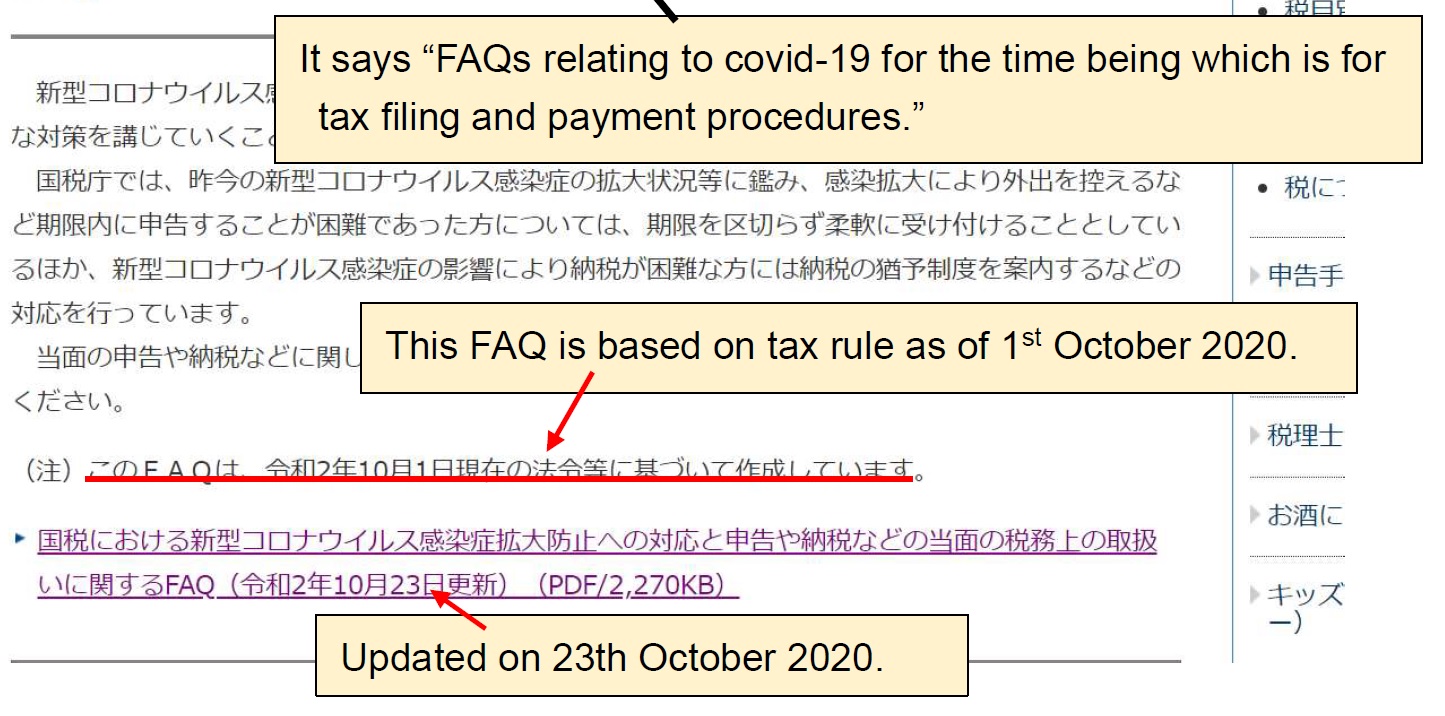

On 23th Oct, Japanese Tax Office updated the treatment of tax matter for the time being.

↓

It contains many topics but these one are related covid-19 and teleworking.

↓

As they say, these are “当面の”, that means, “for the time being”.

So until they would announced new rules, these treatment are applied to the person who works at home remotely.

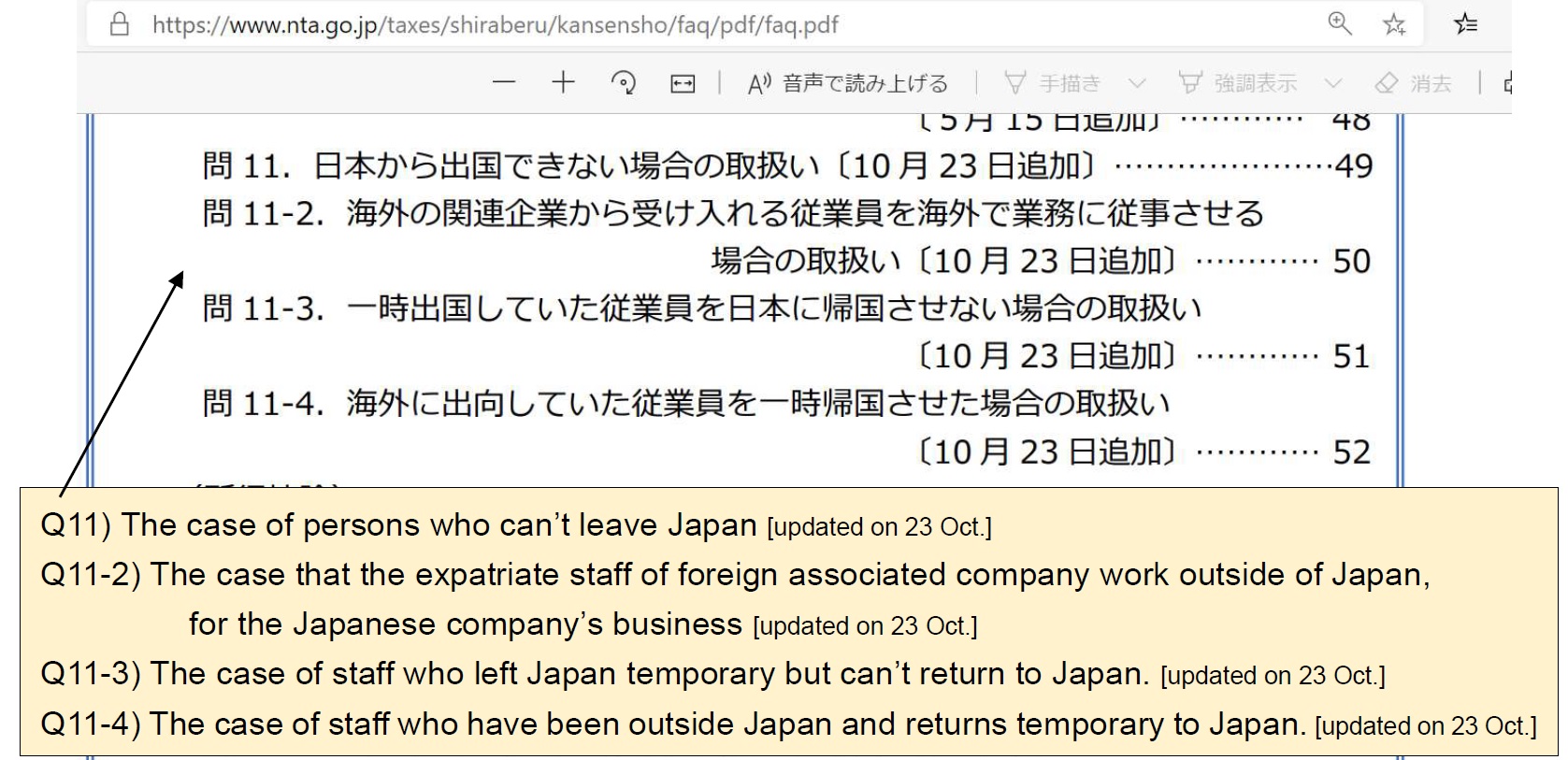

Here’s all sentences from Q11 to Q11-4 which you can read both in English and in Japanese.

If you think it’s quite long sentences and complicated, please take a look at the summary below;

↓ ↓ ↓

Q11) The case of persons who can’t depart from Japan

I changed my job and began to work for foreign company.

At first, I was going to work outside Japan (for more than one year) but I can’t depart from Japan because of world-wide spread of covid-19.

As a result, for the time being, I work for the foreign company’s business from my home in Japan.

Japanese Income Tax is not withheld from the salary the company pays for me.

Do I need to pay Japanese income Tax? This foreign company doesn’t have any office/bases in Japan.

Tax Office’s Answer for Q11)

As for your question, you work at home located in Japan and work for foreign company.

As a result, you are treated as “a person who has address in Japan”, that is, a resident.

Therefore, even though your work place is supposed to be outside Japan, you need to do tax filing for the income you receive from the foreign company.

When a person who was going to work in Japan but couldn’t enter, and, has to work at his/her country

(that includes working at his/her home located outside Japan), the person is regarded as non-resident of Japan.

Q11-2) The case that the expatriate staff of foreign associated company work outside of Japan, for the Japanese company’s business

Our company (domestic one) was planning to accept an expatriate staff from foreign parent company.

But the staff now works for our company’s business staying outside Japan because of travel restrictions due to covid-19.

Do we need to withdraw Japanese income tax from that person’s salary?

Tax Office’s Answer for Q11-2)

As for your question, that expatriate staff from parent company is non-resident because he/she doesn’t have any address in Japan.

And, when the non-resident employee receives salary based on work in foreign country, it is not taxable for Japanese income tax because it’s not regarded as domestic source income.

Therefore, your company doesn’t need to withdraw Japanese income tax from that person’s salary.

(For your information)

When the expatriate person of the foreign parent company will be invited as a board member of your company, the different rule is applied in some cases.

Q11-3) The case of employee who left Japan temporary but can’t return to Japan.

Our company (domestic one) send some employees out to foreign subsidiary company and they usually stay for three months.

But, because of travel restrictions due to covid-19, now they stay at the foreign country over three months.

They work for our company’s business and we pay their salary.

In that case, is there any different procedure for the salary paid during scheduled three months and for other period?

These employees usually live their families in Japan and will do after getting back to Japan.

Tax Office’s Answer for Q11-3)

As for your question, they temporary live in foreign country but have their address in Japan.

It means they are resident.

Therefore, your company should withdraw Japanese income tax from their salary in the same way as before,

because they are residents in Japan.

Q11-4) The case of employee who have been abroad and returns temporary to Japan.

Our company (domestic one) send some employees out to foreign subsidiary company and they usually stay more than one year.

But, because of world-wide spread of covid-19, we asked them to come back to Japan temporarily and after that they work for that foreign subsidiary company’s business, staying in Japan.

Other than the regular salary from the foreign subsidiary company, they receive the vacant home allowance from us which adjust their salary level.

Is it true that the person who temporarily get back Japan, like that case above, doesn’t need to pay Japanese income tax according to International Tax Treaty?

Do we need withdraw income tax from the vacant home allowance?

And also, do they need to do tax filing in Japan?

We haven’t changed payment way since they got back, and the foreign subsidiary company doesn’t have any branch/base in Japan.

Tax Office’s Answer for Q11-4)

Even when the income is regarded as taxable one, you don’t need to pay Japanese income tax by taking some procedures

if there’s a tax treaty between Japan and the country where the employee lives and he/she meets the following conditions which determined by the tax treaty,

that is, “tax exemption for short-term residents” below;

【Tax exemption for short-term residents】

These three things are required;

1) Stay for 183 days or less during taxation year or continuing 12 months.

2) Employer who pays your salary/fee is not resident of the country where the work was done.

3) Any employer’s branch office or other permanent establishment where the service is provided do not owe the duty of paying the salary/fee.

※Note; These requirement are general principals and there can be something different depend on each tax treaty.

Please check your actual case if you want to know exactly.

【About the vacant home allowance paid to them by domestic company while they temporarily stay in Japan】

Even after a non-resident employee temporarily got back to Japan, this person is still regarded as a non-resident because he/she doesn’t have any domestic address.

And, about the vacant home allowance paid while the employee temporarily stays in Japan, it regarded as the salary based on work in Japan,

so it should be taxable as the domestic resource income.

Based on the above, the vacant home allowance paid while the employee temporarily stays in Japan doesn’t meet the requirement 2),

so the tax exemption for short-term residents is not applied to him/her.

It means that he/she is a non-resident in Japan and 20.42% of withholding income tax is needed when the salary is paid.

【The salary paid by the foreign subsidiary company】

When the foreign subsidiary company pays salary for the non-resident employees while they temporarily stay in Japan,

the salary should be based on work in Japan and is taxable as the domestic source income.

About this salary, withholding income tax is not needed because it’s not paid in Japan.

But the employees need to make tax filing form and submit it to Japanese Tax Office, as the domestic source income.

—————————————–

Even it’s the “summary”, must be quite long sentence.

And one more thing, this is also important matter for the company/person who run a business in Japan.

That is, “Permanent Establishment”.

What I let you know above is about “salary”.

So, if you’d like to know correctly what is the domestic source income when you run a business,

please check the other website such as Jetro, or, Tax Office’s one.

Thank you for reading, and have a nice weekend.