When you decide to open your own business in Japan,

you must pay attention to sales tax, as well as to income tax.

There’re many rules to filing sales tax which is very complicated,

and I recommend you ask accountant, like me.

( In Japan, they’re called “税理士(Zeirishi)” or “会計士(Kaikeishi)”)

Even you can ask someone, it’s better for you to know the basic rules.

Today, I explain one of them, that is ;

When the liability of sales tax will occur ?

Actually, the answer is depend on whether your business is

self-employed type or company.

First, I mention the case “self-employed type“, for example,

↓ ↓ ↓

You start your own business as “self-employed type”, in June.

In the first year, the amount of sales is JPY7,000,000

and next year’s, JPY12,000,000.

In 3rd and 4th year, it’s about JPY20,000,000.

When the amount of sales become over JPY10,000,000,

you’re supposed to filing sales tax 2 years later.

And in that case you have to pay the 4th year’s sales tax

by the end of March , in 5th year.

Next, I mention the case “company“, for example,

↓ ↓ ↓

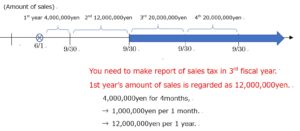

You established a company in June, and you decide

the fiscal year end is September.

In the first year, the amount of sales is JPY4,000,000

and next year’s, JPY12,000,000.

In 3rd and 4th year, it’s about JPY20,000,000.

In the case of company, different from individual,

if the first fiscal year contains less than 12 months,

you have to culculate the monthly amount of sales.

( in that case, 4,000,000yen ÷ 4 months = 1,000,000yen)

When the result of “monthly sales” ×12 is over 10,000,000yen,

you’re supposed to filing sales tax 2 years after that year.

And in that case you have to pay the 3rd year’s sales tax

by the end of November , in 4th year.

If you’re going to establish a company and you’ll get sales

about 834,000yen ~ 840,000yen per month …

it’s better that the first fiscal year contains 12 months.

::::::::::::::::::::::

Does it make sense to you ?

Actually, what I mentioned above is just one of general rules.

In some cases, you’ll have to pay sales tax from the first fiscal

year or second.

On the other hand, you could claim back sales tax if your business

is exporting or if you spend a lot of money than the amont of sales.

But in that case, there’re many things you have to notice.

I’ll tell you next time. :)

Thank you, have a nice day !